It is the total salary an employee gets after all the necessary deductions. The salary calculator consists of a formula box, where you enter the Cost To Company and the bonus included in the CTC. Both the employer and the employee contribute 12% of the employee’s basic salary each month to the EPF or employee provident fund.

As per Section 10 of the Income Tax Act, the HRA is partially or fully tax-exempt. For those who do not stay in a rented home, the HRA will be fully taxed. You only need to be aware of the old or new tax system, CTC, starting salary, monthly rent payment, monthly HRA, monthly health insurance premium, and monthly EPF amount.

Each month, your employer and you each contribute 12% of your base income to the EPF . As per Section 80C of the Income Tax Act of 1961, one can detect the contribution to the EPF on their will. Many individuals are confused between gross salary and CTC.

The amount varies among companies, based on the number of benefits. Thereafter, you need to deduct the yearly professional tax from the gross salary. For this example, we will assume it is ₹2,500 in your location.

Fisdom’s take-home salary calculator also provides the monthly take-home salary amount along with annual. This makes it easier for an employee to know the amount he/she would have at his/her disposal every month. The take-home salary of an employee is the net amount that remains after considering deductions from gross salary.

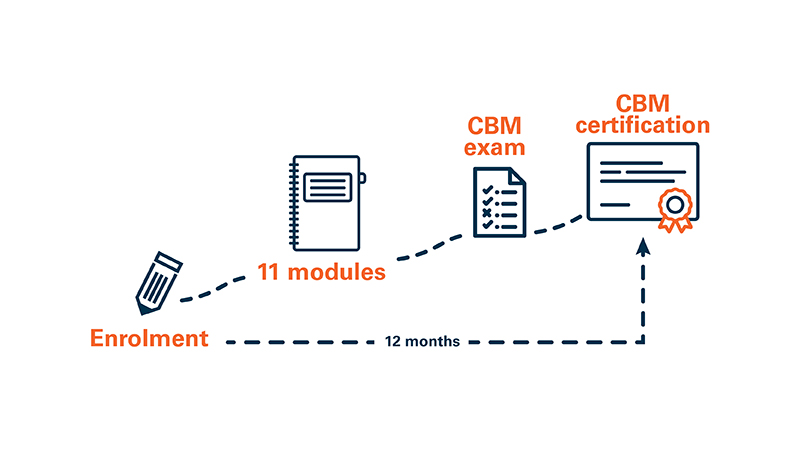

Report: Upskilling Trends in India for 2023

Moneyjigyasu is a blog to share tips and resources on money concepts, personal finance and investing, based on personal experience and insights from experts. Hi, I am CA with a passion for personal finance and investing. I use this blog to share helpful money gyan that I have learned the hard way. You can choose the other components like HRA, LTA, Children Education Allowance etc. up to certain limits. Nowadays, companies usually give you the flexibility to choose your CTC structure by keeping only the Basic Salary, Provident Fund and Variable Portion mandatory.

Here is the simple take home salary calculator, which you can download in Excel format and know your estimated in hand salary with salary break up. A portion of the employee’s salary is placed in their PF account. The contribution is made by both the employer and the employee. The PF account is funded with 12% of the employee’s basic wage. Or else, just enter your salary i.e salary without availing exemptions such as HRA, LTA, professional tax and so on. Choose the financial year for which you want your taxes to be calculated.

It is highly recommended by experts from Vakilsearch to use the salary calculator for easy calibration. In exchange for your services, your employer may provide you a gratuity. You must have worked for an organisation for at least five years in order to be eligible to receive a gratuity. However, in the event of an employee’s passing or their becoming disabled due to a sickness or accident, gratuity may be paid before the five-year mark. Many people may be perplexed by the above wage breakdown.

Indirect benefits usually include free meals, cab services, etc. The ClearTax Salary Calculator asks you to enter the bonus as a percentage of the cost to the company or a fixed amount to calculate the performance bonus. It subtracts the performance bonus from the cost to the company to give you the gross pay.

House Rent Allowance (HRA)

Attorney services are provided by independent attorneys and are subject to a separate Attorney Agreements. If you leave before completing 5 years, your employer may not pay you the full amount. In many cases, people negotiate with the new employer to pay them the lost gratuity by way of Joining a bonus. We have calculated employee insurance premium for an assured amount of Rs 5 lakh. The amount of income tax withheld is known as TDS in India. ₹5,16,600 will be the final take-home salary based on the salary calculator.

The gross salary is always higher than your take-home salary as the amount is calculated before deductions such as EPF contribution, taxes, and others. A take home salary/ in-hand calculator is an automated tool that helps you figure out your net salary after taxation. It also considers all the bonuses and deductions applicable. Neha has income from interest from savings account of Rs 8,000 and a fixed deposit interest income of Rs 12,000 during the year. Here are the deductions Neha can claim under the old tax regime. You can contribute up to 100% of your basic salary plus a dearness allowance, which is higher than the average PF contribution of 12% of one’s base pay.

- Stands for “Cost To Company” or “cost of hire” and refers to the cost to the company of hiring a new employee.

- You must’ve also wondered what your salary growth would look like in the next five-ten years.

- A Form 16 is a certificate issued by an employer to an employee, specifying the amount of tax deducted at source from the employee’s salary.

- This can be used for calculating components of CTC as well as the In-Hand Salary.

- Click on the spinning disks or use the quick links toolbar to access supporting tax and finance calculators, articles and guides.

- It is the housing allowance that one employee receives from the employer.

It is expected that for workers who live in non-metropolitan areas, the amount will be 40% of their basic pay. This amount is partially or completely free from taxation as per Section 10 of the Income Tax Act. However, to estimate the income tax on the basis of all taxable deductions, ET money’s income tax calculator can be used. CTC (Cost-to-Company) is the total cost that an employer incurs on the employee. It is estimated by adding the basic salary along with direct and indirect benefits offered to the employee. The take-home salary calculator uses CTC and total deductions to measure the in-hand salary.

Indiana Local Tax Rates

You can highlight your past performances, any valuable achievement, with your previous employer that might warrant a raise. Experience—The more experience a person has within his industry or profession, the more likely his salary will increase over the years, given that they stay within the industry. The experience in the industry provides sufficient proof that they are probably somewhat skilled. Employers see these as good signs and are more willing to increase a worker’s salary. Professional tax is the tax on employment levied by the state. The state can charge the maximum amount of Rs 2,500 as a professional tax in a financial year.

Savings Contributions

Read further on how different CTC components affect your take home salary. This tool will allow you to create a salary illustration for India and then send this to yourself, a friend, colleague, employee, potential employee etc. Calculates your Net Salary, Income Tax, PF, EPF and Gratuity.

“in-hand” is a word used in daily life to mean the final amount received after the deduction of taxes. HRA or House Rent Allowance is the part of your salary calculate take home pay india that is provided to you by the employer towards your rented accommodation. You are eligible for claiming HRA if you are living in a rented property.

But, if you do not stay in a rented property, the entire component is taxable. In the Interim Budget of 2019, interim finance minister Mr. Piyush Goyal announced an increase in the existing tax-free gratuity limit to Rs.30 lakh. A Voluntary Provident Fund is a type of PF in which an individual can pay a percentage of his\her pay to an Employee Provident Fund account. You must remember one point that this is a voluntary plan, and there is no compulsion that each company has to contribute an equal amount to the EPF. An employee can seek exemption for such allowances by producing bills or proof of expenditure to their employer before the end of the fiscal year.

However, you will receive a higher payout on retirement, which is the government’s motive behind this move. The new wage code says that these excluded items cannot be more than 50% of the total remuneration. If these exclusions cross 50% of the total remuneration, they will be added to the “wages” component. Let us assume you also have a deduction of ₹3,000 per year towards employee insurance.